child tax credit 2021 dates irs

Last year we received a letter from the IRS saying we will be receiving the Advanced Child Tax Credit. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the.

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

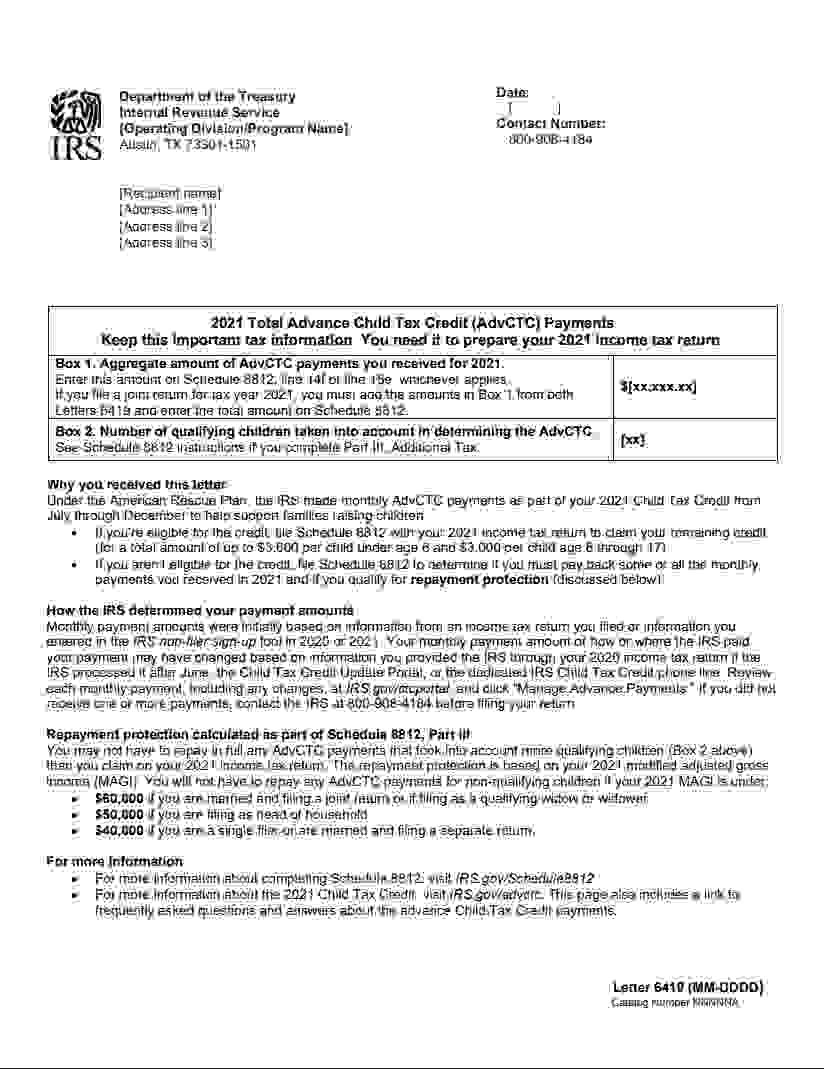

To reconcile advance payments on your 2021 return.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

. Parents income matters too. It doesnt matter if they were born on January 1 at 1201 am. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

15 opt out by Nov. Several months after July 21 I noticed we did receive anything. IRS revises 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions Graham ONeill 16939.

You can check eligibility requirements for stimulus. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. 15 opt out by Nov.

The IRS sent six monthly child tax credit payments in 2021. Date Date 1 - 1 of 1 previous page. I waited another month and checked their website.

The advance is 50 of your child tax credit with the rest claimed on next years return. NOVEMBERs child tax credit cash will be sent out to parents in need across the country next weekThe stimulus check part of President Joe Bidens. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Video TopicIRS Latest Guidance on Child Tax Credit 2022 - Child Tax Credit Schedule 8812The Internal Revenue Service has updated its answers to frequently a.

Or December 31 at 1159 pm if your child was born in the US. The IRS bases your childs eligibility on their age on Dec. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

I remember looking somewhere on the IRS site that the checks were mailed but then returned back to them so they never made it. Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. IR-2022-10 January 11 2022. Ad The new advance Child Tax Credit is based on your previously filed tax return.

600 in December 2020January 2021. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year. IR-2021-218 November 9 2021.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The IRS will soon allow claimants to adjust their income and custodial. This first batch of advance monthly payments worth.

15 opt out by Oct. 1200 in April 2020. Will they send any more in 2022.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021.

But because the IRS is providing an advance on the tax credit the agency wont begin accepting 2021. 13 opt out by Aug. 15 opt out by Aug.

31 2021 so a 5-year. IRSgovchildtaxcredit2021 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of your 2021 income using the Child Tax Credit Update Portal CTC UP.

The Michigan mother of three including a son with autism used the money to pay. Enter your information on Schedule 8812 Form. If they opt-in for the final payment of 2021 before the deadline date.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Payments begin July 15 and will be sent monthly through December 15 without any further action required. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. These FAQs update PDF. This extensive FAQ update PDF includes multiple streamlined questions for.

CHILD TAX CREDIT THE FIGURES. Since July 15 the IRS started doling out monies to eligible families with the CTC. The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible families with children ages 17 or younger.

In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly. Do not call the IRS. 7 Ways to Avoid an IRS Audit.

The only caveat to this is if you and your childs other parent dont live. Get your advance payments total and number of qualifying children in your online account. WASHINGTON The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit to help eligible families properly claim the credit when they prepare and file their 2021 tax return.

IR-2021-153 July 15 2021. The new feature announced on Friday allows families to update their location to avoid mailing delays or even having a check returned as undeliverable. 034 ET Aug 28 2021 THE IRS has launched a new tool for parents to update their mailing address in order to receive Child Tax Credits.

Our phone assistors dont have information beyond whats available on IRSgov. 29 What happens with the child tax credit payments after. 1400 in March 2021.

Important Dates for Tax. IRS - The Basics. A childs age determines the amount.

The American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for tax year 2021 only.

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Irs Child Tax Credit Payments Start July 15

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Irs Cp 08 Potential Child Tax Credit Refund

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

The Irs Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax Refund

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back